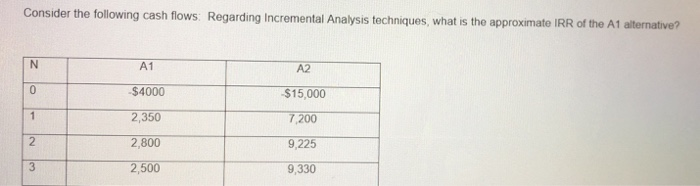

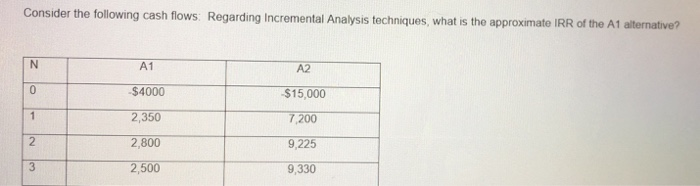

Let us study the internal rate of return formula using solved examples. The term internal here signifies the fact that the calculation of rate using this method does not include external factors, such as inflation, risk-free rate, the cost of capital, or any financial risks.

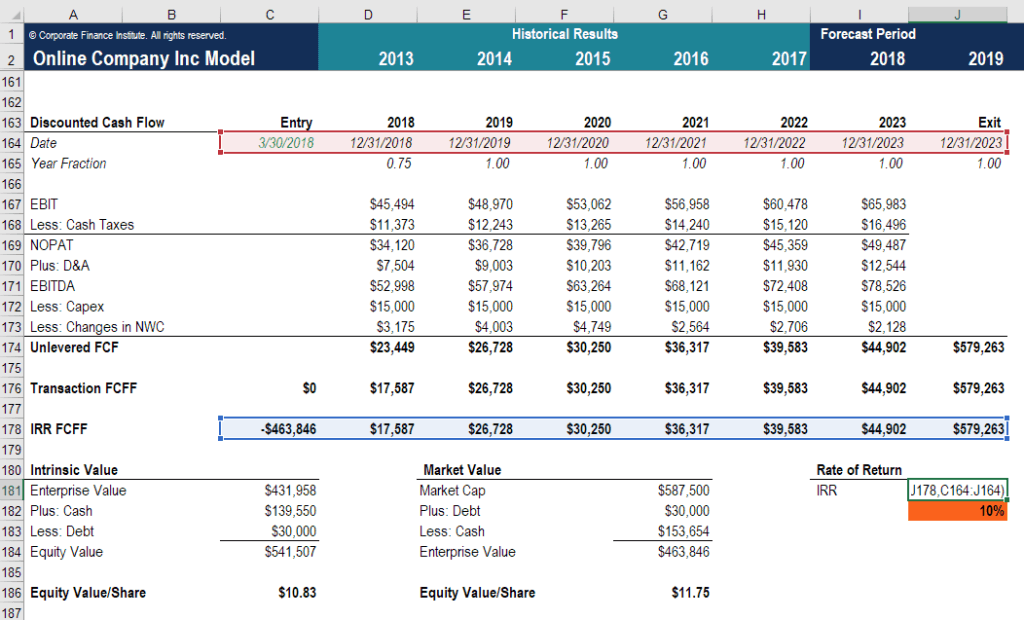

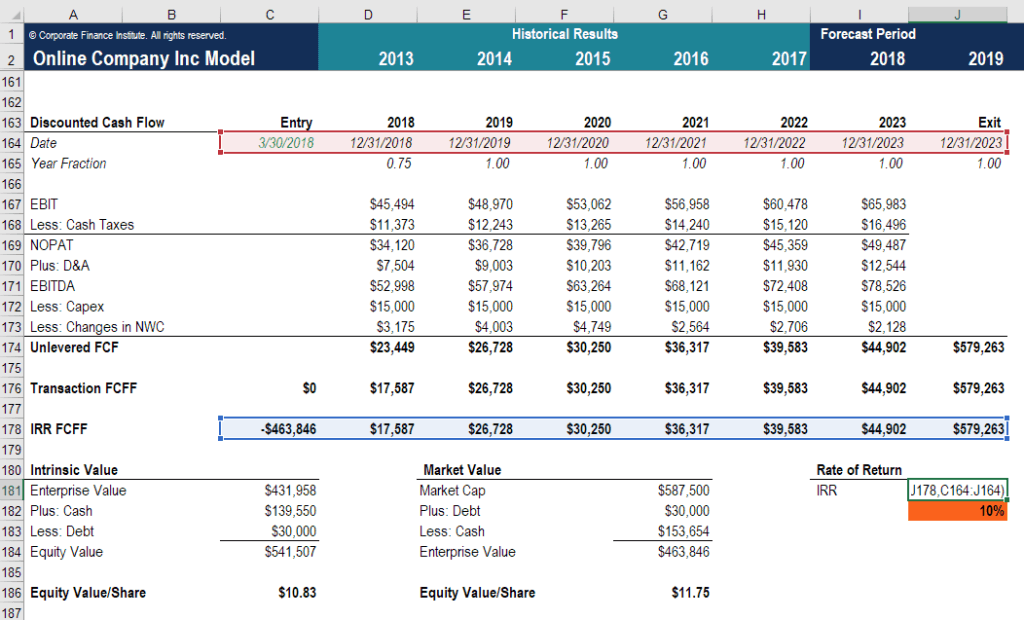

The internal rate of return formula calculates IRR, which is a very important component of capital budgeting and corporate finance which is used in determining which discount rate will make the initial cost of a capital investment equal to the current value of future cash flows post-tax. You can learn more about these measures and the MIRR by using your favorite search engine.The internal rate of return (IRR), also referred to as the discounted cash flow of return (DCFROR), is the interest rate that makes the net present value zero.

The Financial Management Rate of Return (FMRR) is nearly identical to the MIRR, and has been used by real estate investors for decades. The Profitability Index is the present value of future cash flows divided by the investment. Find the average interest rate that grows your adjusted investment (step 1) into your adjusted return (step 2).įor further study, MIRR uses logic that’s related to two other financial measures:. Find the future value of positive cash flows incurred in any year during the course of the investment, growing them at the Reinvestment Rate. Find the present value of negative cash flows incurred in any year during the course of the investment, discounting them at the Finance Rate. Luckily, the logic that supports the MIRR is easy to understand: This is particularly true of a calculation on which you might base an investment decision. It’s always dangerous to treat an Excel function like magic. To illustrate, if the Finance Rate is 8% and the Reinvest Rate is 3%, the MIRR of the four cash flows shown above would be: The reinvest_rate argument is the interest rate that you would earn on cash that the investment generates during its life. The finance_rate argument is the annual interest rate that you would pay to cover any negative cash flows incurred during the life of the investment. It is an array or cell reference to the cash flows for which the MIRR is to be calculated. The values argument is the same as the values argument for the IRR. =MIRR(values, finance_rate, reinvest_rate) Therefore, Excel offers a different solution, the MIRR (Modified IRR) function.Įxcel’s MIRR function is an alternative to the IRR function. However, the idea of an IRR is so widely accepted that this is difficult to do in many companies. The McKinsey consultants offer the best advice about the IRR: Avoid it. In the third example, the returns and repayment are triple each of the initial transactions. In the second example, the returns and repayment are double each of the initial transactions. From this point of view, the IRR equals 0%. In the first example, the returns on each investment, and the repayment for the cash borrowed are the same. All produce the same Net Cash Flows shown above. All three can be seen as a combination of investments and borrowings. These three tables illustrate the three possible results. To illustrate, the cash flows shown at the right produce three completely different IRRs. Each time your cash flows change from negative to positive, or from positive to negative, the calculation generates an additional solution. For projects expected to generate a lot of cash during the course of an investment, the IRR calculation therefore can overstate the financial benefits significantly.Īnother problem with the IRR is that it can produce multiple results. The calculation assumes that this cash will be reinvested at the rate calculated by the IRR.

One problem with the IRR calculation concerns its assumption about cash generated during an investment.

MacCormack about the dangers of using the IRR. CFO magazine republished the article in October of that year. In August, 2004, The McKinsey Quarterly printed an article by John C. A high IRR is a good thing a low IRR is a bad thing. When you know the IRR of a prospective investment, you seem to know all you need. The calculation of an Internal Rate of Return is very appealing…at first glance.

0 kommentar(er)

0 kommentar(er)